July 17, 2024 - The Financial Market Commission released today a new platform to compare investment costs in mutual funds offered by General Fund Managers (GFMs) supervised by the Commission. It details the costs of investing in the mutual fund industry, and is focused on "retail" investors, i.e., parties whose contribution is up to CLP 50 million; "high net worth" investors, whose minimum investment amounts are over CLP 50 million; and "APV clients", who invest in funds intended to build a voluntary pension savings plan (APV, for its Spanish acronym).

While costs are an important factor in investment decisions, they are not the only variable to pay attention to when investing. Consideration should also be given to other factors such as the fund's performance, its risk level, and the GFM's quality of service, among others.

The new platform is part of the CMF's work agenda to promote a more transparent financial market and has the following objectives:

- Provide clear, simple information on the costs of mutual funds marketed in Chile.

- Promote greater competition in the fund industry.

- Contribute to better financial education.

The mutual fund industry in Chile manages investments of around US$ 60 billion and has close to 3 million participants, making it one of the most important sources of savings in the economy. A significant part of this savings belongs to small investors, who invest in different types of instruments, which sometimes constitute APVs. Accordingly, the platform includes various sections so individuals can compare investment costs in a dynamic and simple way to make better-informed decisions when choosing the best investment alternative in different GFMs.

All the above considers factors such as investors' risk tolerance levels, investment horizons and liquidity needs, among others.

The platform presents information on both direct and indirect costs for different mutual fund categories. All direct remunerations and expenses affecting the fund's performance are considered, as well as indirect costs in cases where these funds invest in other vehicles or underlying funds.

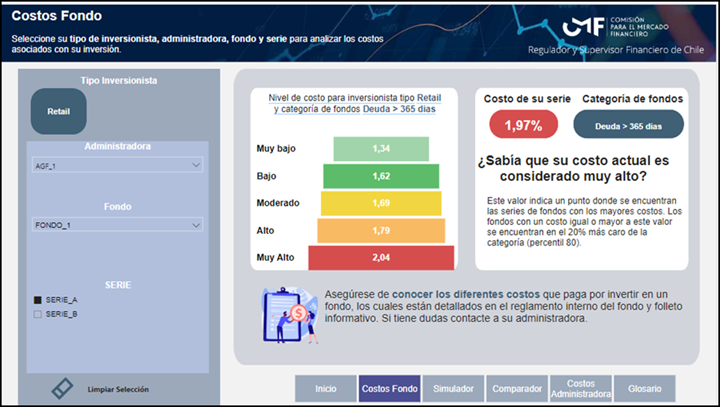

To facilitate comparisons, the Commission's tool allows selections by type of investor, fund manager, fund, and series. It also classifies selected alternatives through a color-coded investment cost classification. Fund series classified as "very high" in terms of investment costs, i.e., when they are in the top 20 percent of their category, are shown in red. Conversely, green represents the "very low" costs for each category (in the bottom 20 percent).

Costs by Fund

(Percentage of net assets as of the first quarter of 2024)

The platform also includes a section to incorporate and simulate the effect of investment costs on long-term accumulated savings.

Savings Simulator

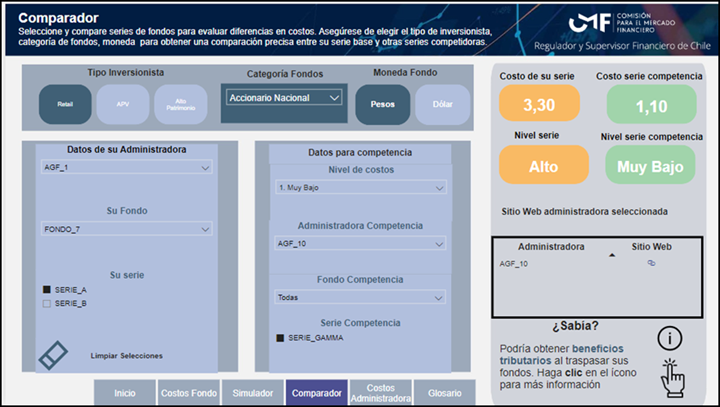

It's also possible to compare series belonging to the same fund category, investment types, family and currency to other funds managed by the same company or its competitors.

Costs Comparator

(Percentage of net assets as of the first quarter of 2024)

The tool incorporates an aggregated view of the industry, allowing selection by type of investor and fund family to visualize average costs at the GFM level.

Costs by Manager

It also includes a glossary to get familiar with key concepts in the mutual fund industry.

Click here to access the Mutual Fund Investment Costs Simulator.