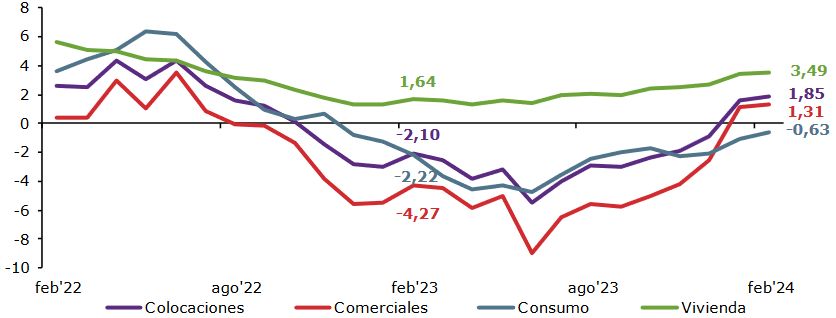

March 28, 2024 - Loans in the banking system grew 1.85 percent in 12 months. This increase was due to a recovery in commercial loans, which expanded by 1.31 percent in 12 months; and a 3.49-percent increase in housing loans. Meanwhile, commercial loans decreased 0.63 percent in that span.

Total loans and loans by portfolio in the banking system

(Real annual variation expressed in percentage)

Purple: Total loans. Red: Commercial loans. Blue: Consumer loans. Green: Housing loans.

In terms of credit risk, the loan-loss provisions index, the arrears ratio of 90 days or more, and the impaired portfolio ratio increased during the month.

Credit risk indices also recorded a general increase across portfolios. Accordingly, the loan-loss provisions index grew from 2.57 to 2.58 percent; the arrears ratio of 90 days or more rose from 2.2 to 2.26 percent; and the impaired portfolio ratio moved from 5.7 to 5.75 percent. This was because of higher coefficients in the commercial and housing portfolios, while the consumer portfolio's index decreased slightly.

Monthly profits for February amounted to 382,318 million Chilean pesos (USD 390 million), increasing by 15.75 percent versus last month but contracting 6.25 percent over 12 months. The return on average equity reached 15.03 percent, lower than last month's; and the return on average assets stood pat at 1.13 percent. Both figures were lower than the ones recorded last year.

Supervised Cooperatives

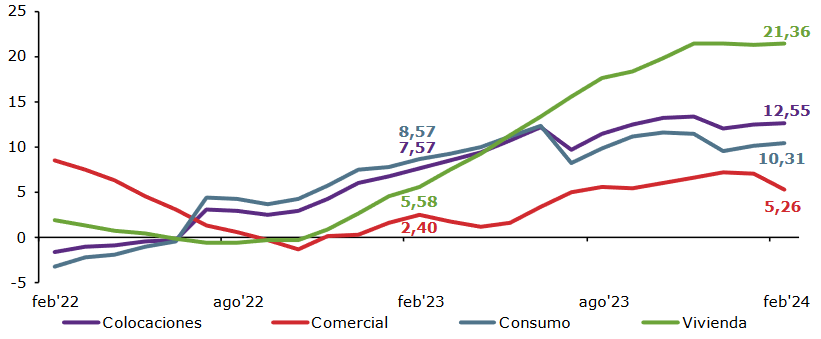

Loans by savings and credit cooperatives supervised by the CMF expanded by 12.55 percent in 12 months. The consumer portfolio, which comprises 71.17 percent of such loans, grew 10.31 percent in that span and is the main reason behind this result. The commercial portfolio increased 5.26 percent and the housing portfolio 21.36 percent.

Total loans and loans by portfolio for savings and credit cooperatives

(Real annual variation expressed in percentage)

Purple: Total loans. Red: Commercial loans. Blue: Consumer loans. Green: Housing loans.

Regarding credit risk, the provisions index, the arrears ratio of 90 days or more, and the impaired portfolio ratio increased during the month. The provisions index was 3.75 percent, the arrears ratio of 90 days or more grew to 2.69 percent, and the impaired portfolio ratio reached 7.9 percent. These trajectories were influenced by consumer loans.

Compared to 12 months ago, the three indices grew on an aggregate basis. However, some decreases were reported in the provisions index for consumer and housing loans, and the impaired portfolio coefficient for housing loans.

Monthly profits for February reached 5,981 million Chilean pesos (USD 6 million), growing 161.46 percent in the month but declining by 25.22 percent in 12 months. The return on average equity was 11.28 percent and the return on average assets 2.55 percent, and both were lower than the ones recorded last month and 12 months ago.

Links to Relevant Documents

- Report on Performance of the Banking System and Cooperatives - February 2024

- Monthly Report on Financial Information of the Banking System - February 2024

- Report on Derivative and Non-Derivative Instruments of the Banking System - February 2024

- Arrears Ratio of 90 Days or More in the Banking System - February 2024

- Report on the Impaired Portfolio of the Banking System - February 2024

- Assets and Liabilities of the Chilean Banking System Abroad - February 2024

- Balance Sheets and Statements of Banks (in plain text format) - February 2024

- Financial Report of Savings and Credit Cooperatives - February 2024