The 24th version of this annual CMF Report details female participation in directorship positions in the financial system; access to and use of financial products by gender; and new data on population coverage of mutual fund investments.

The Report also includes data on businesses led by women and their financial capabilities, as well as an analysis of debt renegotiation results and impairments by gender.

July 22, 2025 - Solange Berstein, Chairwoman of the Financial Market Commission (CMF), presented today the 24th Report on Gender in the Financial System at a joint event with Adolfo Ibáñez University's Business School.

The Commission's Gender Report details female participation in directorship positions in the financial system; access to and use of financial products by gender; and new gender-segregated data on population coverage of mutual fund investments.

"The financial industry shows relevant progress on gender equality issues, such as growing access of women to financial products and a reduction of population coverage gaps, during the last few decades," stated Chairwoman Berstein in her presentation. "However, significant challenges about use intensity, mix and sophistication of products, as well as participation in directorship positions within the industry, persist."

Berstein highlighted that women hold only 17 percent of directorship positions in Chile, a figure below the average of developed countries. It ranks worse than Brazil's 19.8 percent and is significantly behind nations like Canada (39.3 percent) and France (45.5 percent.)

"The Gender Report is part of institutional commitments to promote financial inclusion and highlight gender gaps, which is a very important input to design, implement, and assess public and private policies on gender equality," added the Chairwoman.

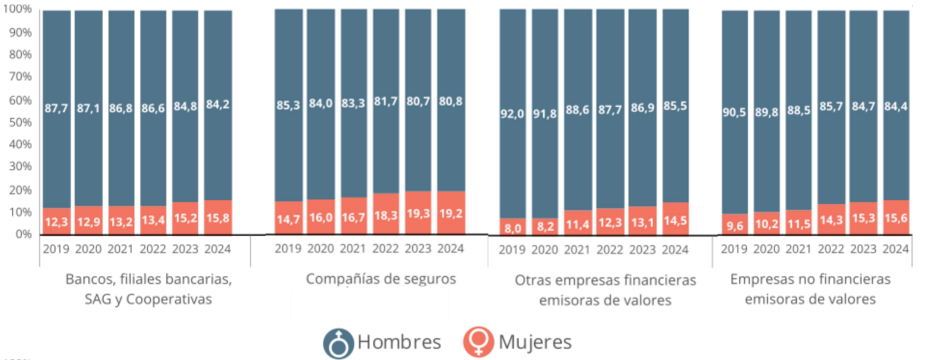

Participation in Directorship Positions

Among entities supervised by the CMF, the Gender Report reveals that the largest gender gaps on directorship positions are in banking subsidiaries and support companies of banking activities (women hold 9.9 percent of such positions), and non-banking payment card issuers (11.1 percent).

Meanwhile, insurance companies (19.2 percent) and the cooperative sector (35.1 percent) show the smallest gaps.

Female participation in Chilean boards of directors

(Percentage of total directors)

From left to right: Banks, banking subsidiaries, support companies of banking activities, cooperatives; Insurance companies; Other financial companies that issue securities; Non-financial companies that issue securities.

Access to and Use of Financial Products

The Report states that cash management products, savings products, loans, and insurance have important population coverage without significant gender gaps in possession of financial products.

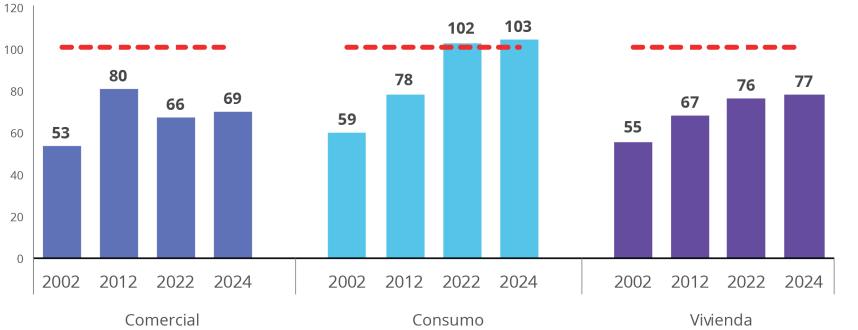

However, gaps persist in amounts linked to such products. While women and men have equal access to loans, the difference in granted amounts and average debt reach 37 and 38 percent, respectively. Disaggregated data shows that women have greater access to consumer loans but significant gaps in housing and commercial loans.

Bank loans: Number of debtors by loan type and gender

(Percentage of female debtors over male debtors)

From left to right: Commercial, consumer, and housing loans. Dotted red line indicates parity.

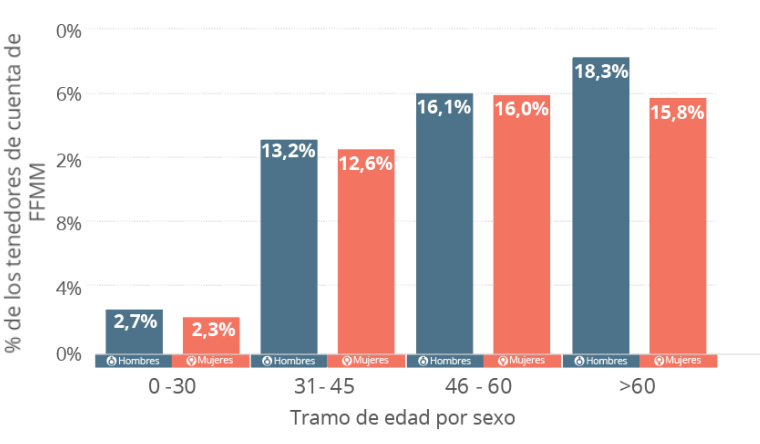

In-Depth Analysis of Mutual Funds

This version of the CMF Gender Report includes new data on population coverage of mutual fund investments by gender. Over 2 million individuals invested in mutual funds as of September 2024, and 49.7 percent of them were women. Participants in mutual funds allocated CLP 33.2 trillion, a figure equivalent to 11 percent of Chile's GDP, and 42 percent of said amount corresponds to investments made by women. On average, men invested CLP 18.2 million in mutual funds versus women's 13.4 million.

Separating mutual fund contributors by income brackets shows that the proportion of women with monthly incomes below CLP 1 million is higher than that of men at 60.8 and 46.9 percent, respectively. For monthly incomes above CLP 1 million, these percentages reverse and show more male than female investors.

An analysis of age groups shows that women have similar coverage than that of men across the board, with larger gaps for people aged 60 or older.

Insurance

Population coverage of insurance policies reveals that the proportion of insured women is lower than that of men, with significant gaps for individuals aged 50 or older. Women show lower insurance possession rates (56.3 percent) than men (58.8 percent) among policyholders.

Payment Behavior

The Gender Report highlights women's better debt payment behavior per their arrears and renegotiation figures. For example, arrears below 90 days decreased from 0.37 to 0.31 percent for women and from 0.46 to 0.40 percent for men.

Meanwhile, women have less debt renegotiations (71 women every 100 men) and less clients in impaired status for consumer and housing debt (57 and 39 women every 100 men, respectively). These figures evidence that women put more priority on dealing with long-term debt.

After the presentation by Chairwoman Berstein, Professor Francisca Pérez of Adolfo Ibáñez University's Business School presented the results of the 2025 Global Gender Rap Report published by the World Economic Forum with a focus on Chile. "The Global Gender Gap Report shows Chile going back in 2025, with a slight increase in gender gaps compared to previous years," stated Pérez. "The main decline is in the economic dimension, which measures women's economic participation and opportunities. This dimension, along with political empowerment, is one of the most lagging areas for the country. Such results challenge us to continue advancing in terms of economic equality, ensuring that women have equal access to the labor market; can fully develop their professional careers; and reach leadership positions," she added.

A panel discussion followed featuring María José Díaz, general manager of ChileMujeres; Cristina Bitar, Director of Comunidad Mujer; Silvia Eyzaguirre, senior researcher at the Public Studies Center; and Chairwoman Berstein. Magdalena Aninat, Director of Adolfo Ibáñez University's Business Futures Center, served as moderator.

Links to Relevant Documents