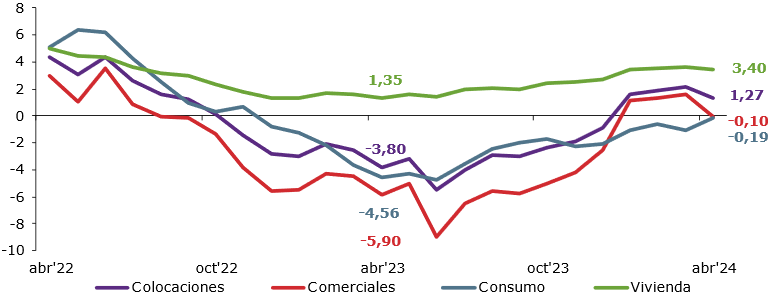

May 31, 2024 - Loans in the banking system expanded by 1.27 percent in 12 months. This growth was due to a 3.4-percent increase in the housing portfolio, while the commercial and consumer portfolios posted variations of minus-0.1 and minus-0.19 percent, respectively.

Total loans and loans by portfolio in the banking system

(Real annual variation expressed in percentage)

Purple: Total loans. Red: Commercial loans. Blue: Consumer loans. Green: Housing loans.

Regarding credit risk, the arrears ratio of 90 days or more and impaired portfolio ratio increased compared to March, while the loan-loss provisions index decreased in that span. By portfolio, commercial saw a rise on all three indices; consumer an overall decline; and housing showed diverging behaviors, with the impaired portfolio ratio rising against a decline in the loan-loss provisions index and arrears ratio of 90 days or more.

Accordingly, the loan-loss provisions index fell from 2.58 to 2.57 percent, and the arrears ratio of 90 days or more moved from 2.24 to 2.26 percent. The impaired portfolio ratio rose from 5.75 to 5.9 percent. Overall, all credit risk indices (including by portfolio) are higher than those posted 12 months ago.

Monthly profits for April reached CLP 436,869 million (USD 463 million), declining 6.04 percent during the month and 0.34 percent versus a year ago. The return on average equity was 14.97 percent, lower than last month's; and the return on average assets was 1.14 percent, also declining compared to March. Both coefficients decreased versus 12 months ago.

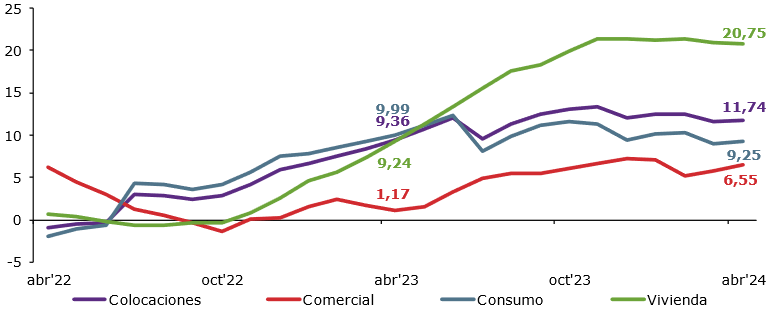

Supervised Cooperatives

Loans by savings and credit cooperatives supervised by the CMF increased by 11.74 percent (over 12 months) during April. The consumer portfolio, comprising 70.88 percent of said loans, expanded by 9.25 percent in that span. The commercial portfolio grew 6.55 percent, and the housing portfolio 20.75 percent.

Total loans and loans by portfolio in savings and credit cooperatives

(Real annual variation expressed in percentage)

Purple: Total loans. Red: Commercial loans. Blue: Consumer loans. Green: Housing loans.

On credit risk, the provisions index stood pat during the month, but the impaired portfolio ratio and the arrears ratio of 90 days or more declined. Indeed, the provisions index was 3.8 percent; the arrears ratio of 90 days or more dropped to 2.46 percent; and the impaired portfolio ratio fell to 7.79 percent.

Behaviors versus March 2024 were due to an increase in the provisions index of the consumer portfolio and drops in the commercial and housing portfolios, resulting in the index not showing any variation. The arrears ratio of 90 days or more and impaired portfolio ratio fell across all three portfolios.

The provisions index and impaired portfolio ratio compared to 12 months ago increased in commercial loans for the former, and consumer and commercial loans for the latter. On the other hand, the arrears ratio of 90 days or more decreased across all portfolios.

Monthly profits for April reached CLP 8,763 million (USD 9 million) for an increase of 2.02 during the month and 5.48 percent over 12 months. The return on average equity was 11.77 percent and the return on average assets 2.63 percent; both increased versus last month but decreased compared to the same month last year.

Links to Relevant Documents

- Report on Performance of the Banking System and Cooperatives - April 2024

- Monthly Report on Financial Information of the Banking System - April 2024

- Report on Derivative and Non-Derivative Instruments of the Banking System - April 2024

- Arrears Ratio of 90 Days or More in the Banking System - April 2024

- Report on the Impaired Portfolio of the Banking System - April 2024

- Assets and Liabilities of the Chilean Banking System Abroad - April 2024

- Balance Sheets and Statements of Banks (in plain text format) - April 2024

- Financial Report of Savings and Credit Cooperatives - April 2024